Banca IFIS presented its latest NPL Market Watch during the main conference of NPL Meeting yesterday.

The main takeaways from the report are that:

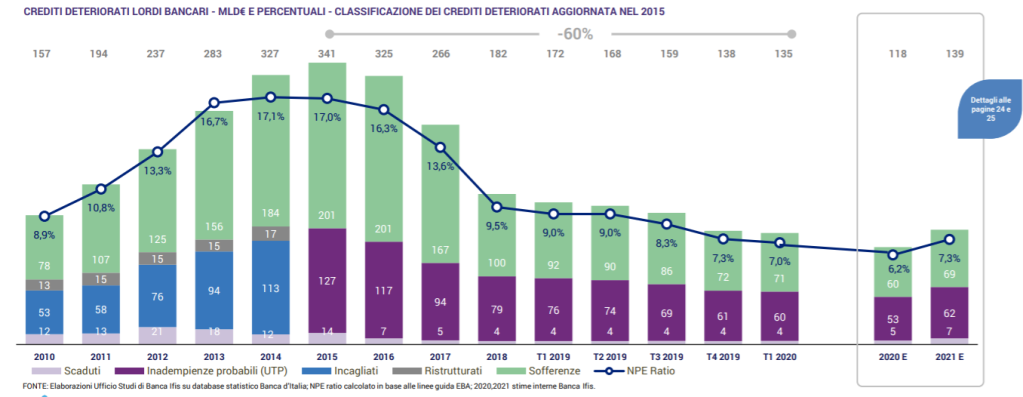

1- The decreasing trend in NPE ratio started in 2015 will be reverted in 2021 when it will rise back to 7.3% from the minimum level of 6.2% expected at the end of 2020

2-Public intervention has delayed the impact of COvid19 and Lockdown measures that will become manifest in 2021

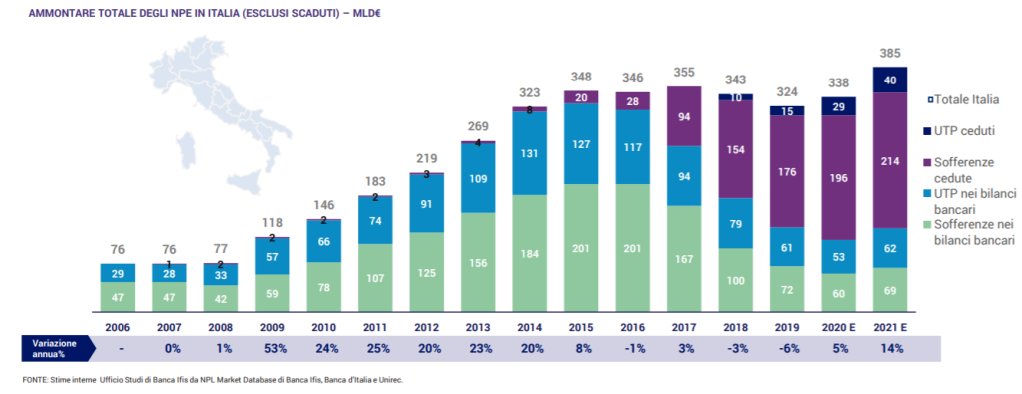

3-The total stock of NPE (including both banks and investors) will reach an all time peak in 2021 at 385bn

The expected new wave of Non Performing Exposures will be a remarkable challenge for banks also because most recent updates in regulation (especially regarding calendar provisioning and default definition) will not be amended to consider current extraordinary situation.

European Commission and ECB will try to promote incentives to develop secondary market and this may include web based marketplace as well as state sponsored asset management companies (I discussed the topic in this post) .

Credit management industry is also about to face a challenge because the substantial increase in the total NPE of the system will happen while the whole economy will be trying to recover from the strong recession caused by covid19 and Lockdown measures.

This could be a good opportunity for those servicers able to handle increased volumes maintaining acceptable levels of performance and for those specialized in segments where competition will not erode profit margins.

The need for large investments (especially in technology) and common cost structure of incumbent large special servicers will most likely favorite a further consolidation in the market.

If you like my updates you can subscribe my newsletter

Link to my updated business profile

Are you interested in Italian banks and NPL/UTP market? Ask for a briefing (in person or via conference call) by sending me a private message. I am also available for consulting projects on Distressed Assets pricing and Portfolio Management.

If you like my updates you can buy me a coffee clicking on the button with the small mug below

You can also support my Patreon Account (from 2€ per month)

GLG – Gerson Lehrman Group – Council Member