Reuters reported that European Central Bank (ECB) is working on an Amazon-style website to sell hundreds of billions of euros of bank loans.

The project should be aimed at increasing the competition on Bad loans secondary market an is expected to be discussed with European Union officials on Friday 25th.

The large number of new NPEs expected in next month due to the impact on economy of Covid19 Pandemic and Lockdown measures may pose a substantial challenge to European Banks that need also to comply to ever tighter regulation on capital and provision.

National government are quite worried for this topic and France and Germany have called on the European Union to ease bank capital and bonus rules to avoid crimping the flow of credit to an economy trying to recover from the coronavirus crisis, a paper seen by Reuters showed.

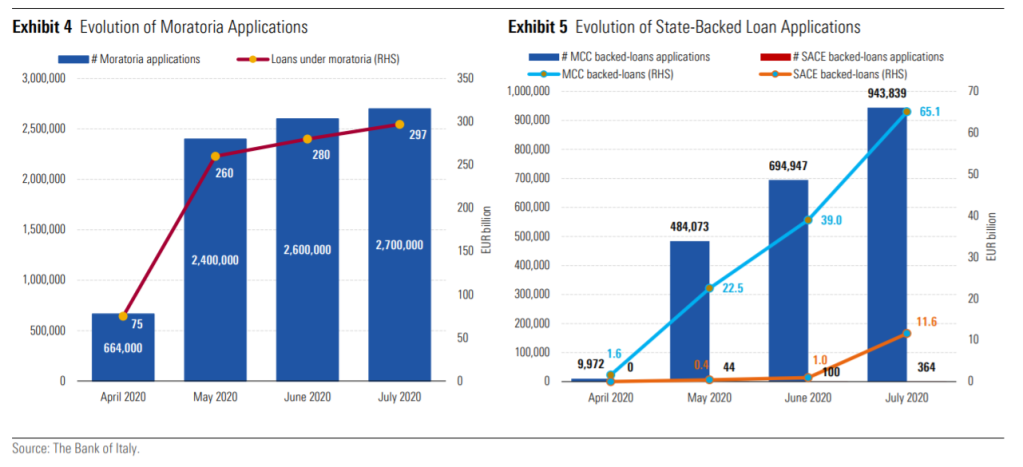

Italian Banks, as stated by Morningstar DBRS, reported a an aggregate net loss of EUR 464 million compared to a net profit of EUR 6.2 billion in the same period of 2019 and supported the Economy handling Moratoria files and State Baked loand

The improvement of Bad Loans secondary market has been a high priority for European Banking Authority (EBA) whose former chief is now head of ECB Banking Supervision and has been supporting the idea of a “Bad Bank” solution based on Asset Management Companies.

Some kind of Extraordinary Measure is widely expected but at the moment market oriented solutions like “the Amazon of Bad Loans” seem more likely than those involving heavy organizations.

I discussed in a previous post the rumors regarding the European Bad Bank pointing out that some non negligible details should be taken in consideration (recovery cost, quality of credit management etc) and that solutions like GACS (italian state guarrantee scheme) are less distortive of market prices.

An “amazon-like” marketplace may seem a good idea and for sure is based on the correct target of increasing competition, nevertheless some specific issue shold be considered

1- Bad Loans are illiquid assets that need detailed due diligence to be properly assessed and specific expertise to be managed this mean that only a limited amount of competitors looking for high yields can access the direct purchase and would be interested in this platform

2-So far Securitization has proved to be the best mechanism to build a liquid market from illiquid assets and a proper tranching of notes would open the door to a number of potential investors way bigger than those potentially interested in accessing the new marketplace

3-The idea of a single wider market is attractive but so far law, procedures and economic environments of European countries are still quite different and require local knowledge to event start thinking of investing in NPLS

European Banks will probably need some help and some kind of extraordinary measure to handle the Bad Loans problem will probably be introduced in order to

If you like my updates you can subscribe my newsletter

Link to my updated business profile

Are you interested in Italian banks and NPL/UTP market? Ask for a briefing (in person or via conference call) by sending me a private message. I am also available for consulting projects on Distressed Assets pricing and Portfolio Management.

If you like my updates you can buy me a coffee clicking on the button with the small mug below

You can also support my Patreon Account (from 2€ per month)

GLG – Gerson Lehrman Group – Council Member